net investment income tax 2021 proposal

In Income Tax Individual Tax Tax Tips. Fortunately there are some steps you may be able to take to reduce its impact.

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

2021 tax reform proposal.

. Fortunately there are some steps you may be able to take to reduce its impact. Expansion of the net investment income tax NIIT to cover net investment income from non-passive activities for taxpayers with greater than 400000 single or 500000 joint as well as for trusts and estates. The proposal expands the scope of the NIIT to include all applicable income regardless of whether or not the taxpayer is a passive investor.

The American Jobs Plan also known as the Infrastructure bill was introduced by President Biden on March 31 2021. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you.

Please refer to our September 13th Tax Reform. In general net investment income for purpose of this tax includes but isnt limited to. Qualifying widow er with a child 250000.

Plan Ahead for the 38 Net Investment Income Tax Posted on July 27 2021 by Brady Ramsay High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Plan ahead for the 38 Net Investment Income Tax.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

Trusts and estates will be subject to lower thresholds at. At first blush the proposal appears to create two parallel systems. Plan ahead for the 38 Net Investment Income Tax Jun 4 2021 Individual Tax High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

Enacts a 5 surtax on modified adjusted gross income over 10000000 and an additional 3 surtax on modified adjusted gross income over 25000000 versus a 3 surtax on incomes above 5000000. The plan proposes spending of 23 trillion over eight years on a variety of initiatives. INDIVIDUAL TAX BRIEF Plan ahead for the 38 Net Investment Income Tax June 1 2021 by Zeitlin Associates CPAs.

SURTAX ON NON-GRANTOR TRUST The Build Back Better Act proposes a 5 tax would apply to the adjusted gross income AGI of non-grantor trust more than 200000. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. NET INVESTMENT INCOME.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

Fortunately there are some steps you may be able to take to reduce its impact. An additional 3 tax would apply to AGI on a non-grantor trust more than 500000. Assume his net earnings from self-employment are US208700.

A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts.

The top individual tax bracket remains 37 versus an increase to 396. The proposal would repeal IRC Section 1061 for taxpayers with taxable income from all sources over 400000 and would be effective for tax years beginning after December 31 2021. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade. Close loopholes in the 38 net investment income tax.

Interest dividends capital gains rental and royalty income and non-qualified annuities. Of particular importance for sellers the surcharge on income in excess of the applicable thresholds coupled with the expansion of the 38 net investment income tax to apply to gain from the sale of limited partnerships or S corporations could increase the tax liability on a portion of the gain recognized for transactions that close during 2022 or later by as much as. July 7 2021.

Income and Investments. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Plan ahead for the 38 Net Investment Income Tax by FPA Admin Jun 8 2021 Uncategorized 0 comments High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. In general net investment income includes but is not limited to. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

All About the Net Investment Income Tax. However in determining his self-employment tax T cannot use the FEIE amount to reduce his self-employment income. Net investment income tax.

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Profit Sharing Calculator For A Startup Business Plan Projections How To Plan Startup Business Plan Start Up Business

Like Kind Exchanges Of Real Property Journal Of Accountancy

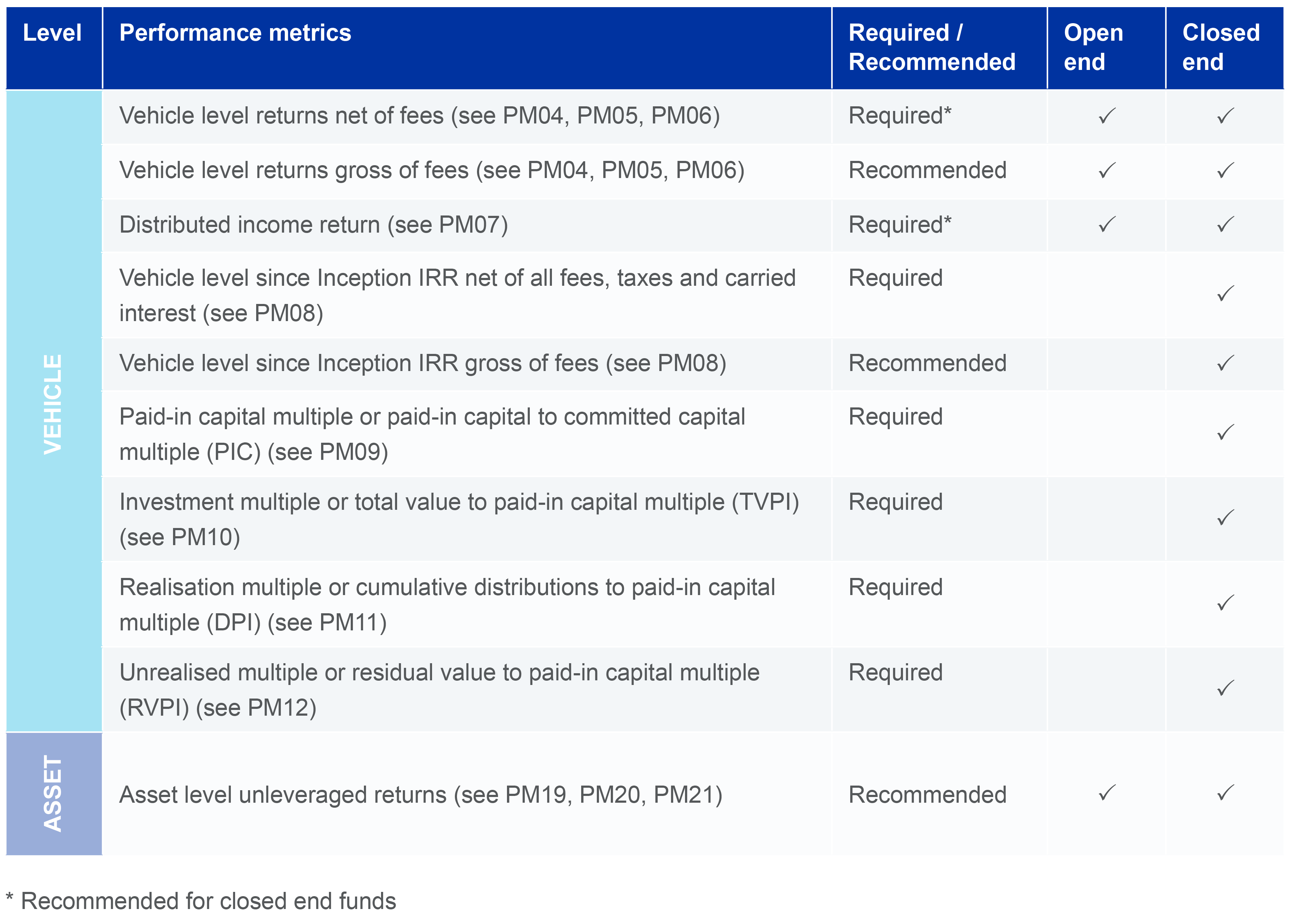

Performance Measurement Inrev Guidelines

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

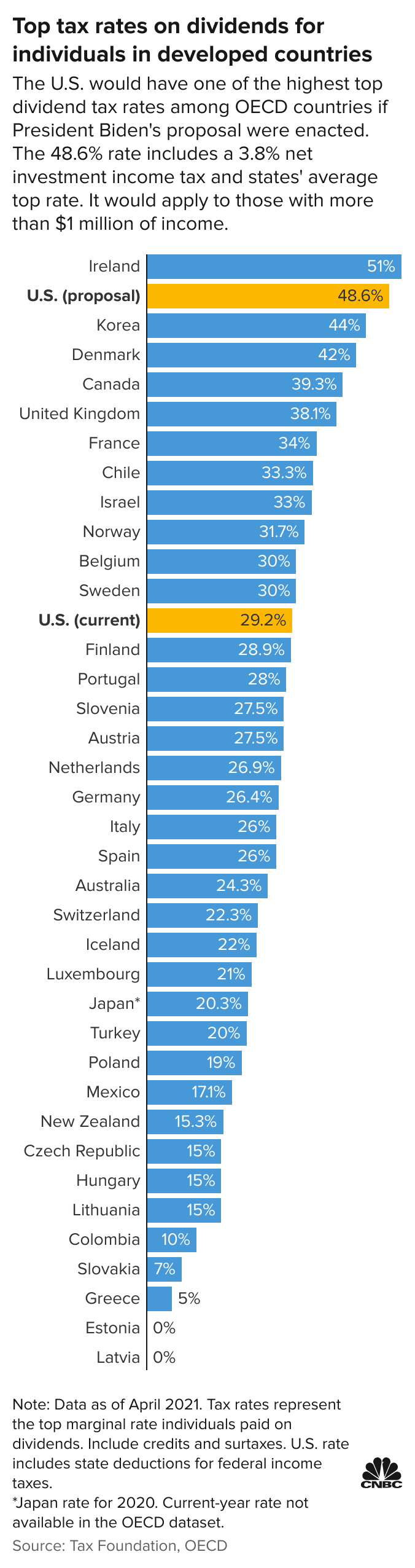

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Fiscal Year 2021 Audi Group Achieves All Time Highs In Operating Profit And Net Cash Flow Audi Mediacenter

Summary Of Fy 2022 Tax Proposals By The Biden Administration

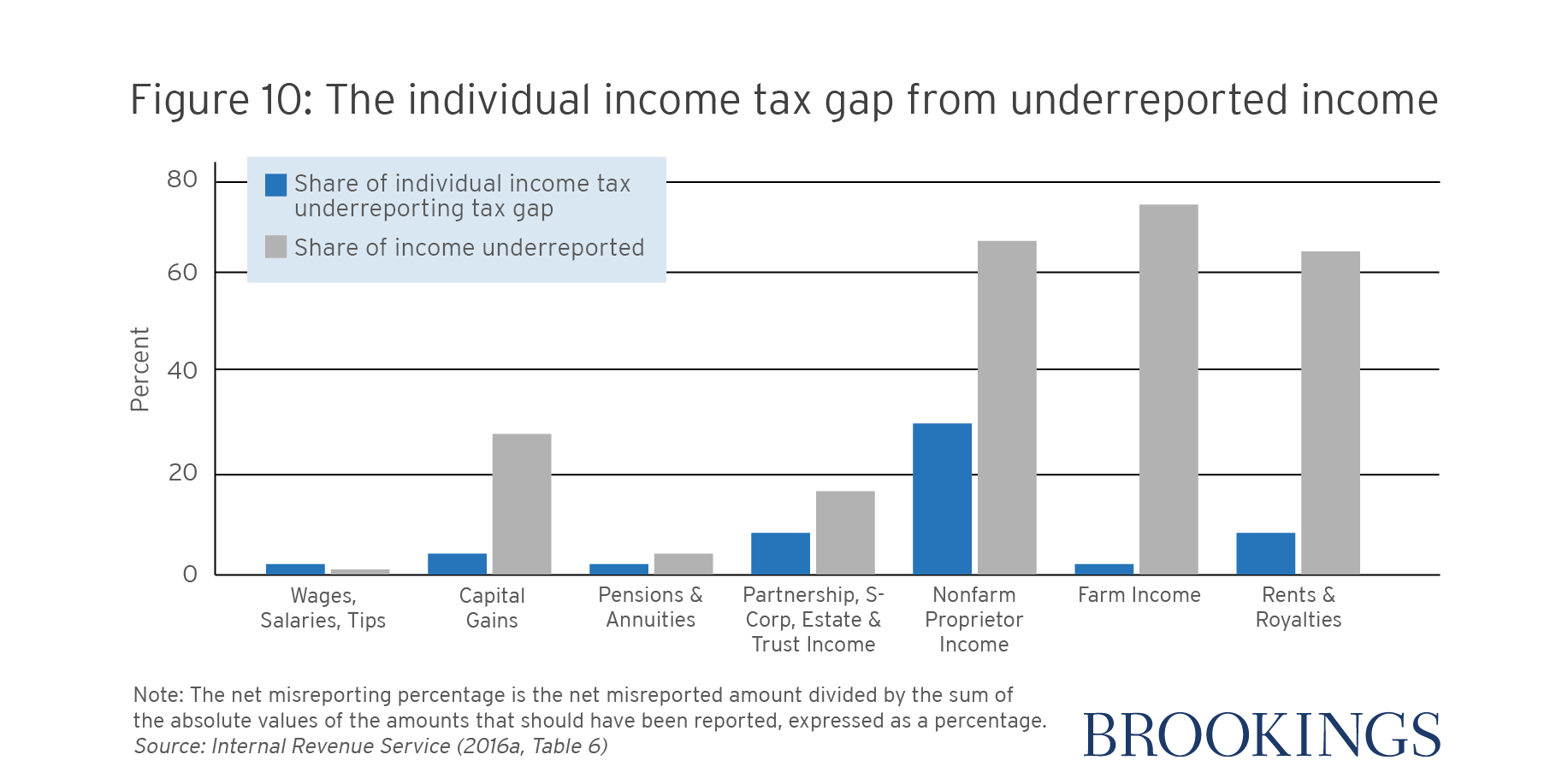

9 Facts About Pass Through Businesses

Business Plan For Kids Ich Hoffe Dieses Arbeitsplan Arbeitsblatt Hilft Ihren Kindern Und Mir Business Plan Outline Business Worksheet Business Plan Template

What Is The The Net Investment Income Tax Niit Forbes Advisor

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

House Democrats Tax On Corporate Income Third Highest In Oecd

European Flag European Commission Brussels 22 12 2021 Com 2021 823 Final 2021 0433 Cns Proposal For A Council Directive On Ensuring A Global Minimum Level Of Taxation For Multinational Groups In The Union Swd 2021 580 Final

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Functions Of Hr Payroll Payroll Software Tax Saving Investment